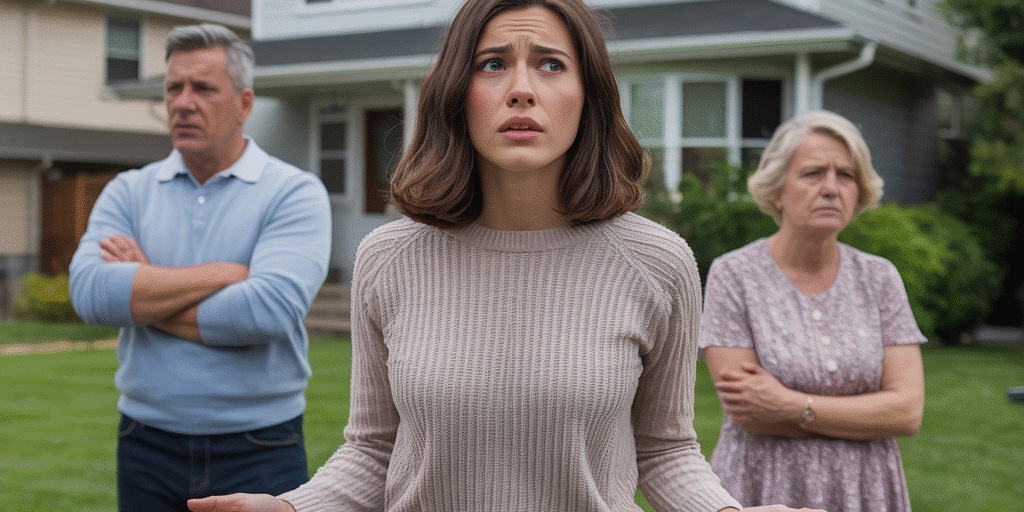

I (34F) never thought I’d be posting here, but I’m sitting in my car in a Target parking lot trying not to scream and I need to know if I’m losing my mind or if I have every right to be furious.

Some background: I’ve been with my husband Marcus (37M) for nine years, married for six. I’m a CPA. Yeah, you read that right. I’m a Certified Public Accountant. I literally manage finances for a living. I handle tax planning for high-net-worth clients. I’ve helped three small businesses avoid bankruptcy through financial restructuring.

But according to my husband, I’m “too emotional and unstable” to be trusted with our household finances.

This started about four years ago. I had been managing our money since we got married—budgets, savings goals, investments, all of it. We were doing great. We’d paid off my student loans, saved a solid emergency fund, and were on track to buy a house.

Then I had a miscarriage.

It was our second one in eighteen months, and I… I struggled. I went to therapy. I cried a lot. I had days where getting out of bed felt impossible. I was grieving, you know? Like a normal human being going through something traumatic.

And that’s when Marcus decided I was “too unstable.”

One day, about three months after the miscarriage, I went to pay our electric bill and my card was declined. I checked our joint account—I’d been locked out. Changed password, and I didn’t have access anymore.

When I confronted Marcus, he sat me down like I was a child and said, “Babe, you’ve been going through a lot emotionally. I think it’s better if I handle the finances for a while. Just until you’re more… stable. I don’t want you making impulsive decisions when you’re not thinking clearly.”

I was too exhausted to fight. I was already in therapy dealing with grief, and he framed it like he was protecting me, protecting us. So I said okay. Temporarily, I thought.

That was four years ago. “Temporarily” became permanent.

He gives me an “allowance”—I hate that word—transferred to my personal account every month. Enough to cover groceries, gas, my therapy copays (which he reminds me he’s “generous” for covering), and a little extra. If I need anything beyond that, I have to ask him. Explain it. Justify it.

Meanwhile, I’m bringing in $87K a year. He makes $92K as an IT project manager. Our incomes are nearly identical, but I have zero visibility into where our money actually goes.

I’ve asked—multiple times over the years—to be added back to the accounts. To at least SEE the budget. To be included in financial decisions.

Every time, he says the same thing: “When you can handle it emotionally, we’ll revisit this. But right now, you’ve been stressed at work, or you’ve been anxious, or you’ve been whatever.” There’s always a reason I’m too “unstable.”

Last year, I asked if we could meet with a financial planner together. He said, “I AM the financial planner for this family. Do you not trust me?”

I stopped asking after that.

But here’s the thing: I never stopped being a CPA. And CPAs notice patterns.

About two years ago, I started keeping track. Nothing crazy, just… observations. I created a spreadsheet on my personal laptop. Every time Marcus mentioned a purchase, every time I saw a receipt lying around, every time he casually mentioned “the mortgage went up” or “insurance is more expensive this year,” I logged it.

Date. Item. Estimated cost. Source of information.

I tracked what I could see of our spending: his new truck (which he bought without discussing with me), the golf club membership, the weekend guys’ trips to Vegas, the $200 dinners with his buddies that he’d mention in passing.

I also tracked what I KNEW our fixed expenses should be: mortgage (based on the house we bought), utilities (I could estimate), insurance (I knew the ballpark), property taxes (public record).

My spreadsheet wasn’t complete—I didn’t have account access, so I couldn’t see everything—but I could see enough to know something was off.

Based on our combined income ($179K/year before taxes) and what I could estimate our expenses to be, we should have been saving at minimum $2,000/month. Probably more. Over four years, that’s nearly $100K in savings we should have built up. Plus the $40K we had in savings before he took over.

I had no idea where that money was. No idea if we even had savings anymore. But I kept tracking, kept updating my secret spreadsheet, and told myself I was being paranoid.

Then, three days ago, everything exploded.

Marcus came home looking stressed. Unusual for him—he’s usually pretty even-keeled. He poured himself a whiskey at 4 PM, which was also unusual.

“My mom called,” he said. “She needs help.”

His mother, Patricia (64F), is not someone who asks for help. Ever. She’s proud, independent, and has always been financially comfortable. His dad passed away five years ago, but he left her with a paid-off house and a decent life insurance policy.

“What kind of help?” I asked.

He sat down heavily on the couch. “She needs thirty thousand dollars.”

I felt my stomach drop. “What? Why?”

Turns out, Patricia made some bad investment decisions. She got talked into some kind of timeshare scheme by a “financial advisor” (aka predatory salesperson), took out a line of credit against her house to invest in it, and now she’s underwater. The timeshare company is threatening legal action, and if she doesn’t pay $30K within sixty days, they’re going to put a lien on her house.

“She’s terrified,” Marcus said. “She could lose the house. The house my dad worked his whole life to pay off. I can’t let that happen.”

My first instinct was sympathy. I love Patricia—she’s been nothing but kind to me. “That’s awful. What can we do?”

Marcus looked at me. Really looked at me, in a way he hasn’t in years.

“I need your help,” he said.

I blinked. “My help?”

“You’re good with this stuff, right? Financial planning, figuring out solutions? I need you to look at her situation and tell me what we can do. Tell me how we can come up with thirty thousand dollars.”

I sat there for a second, trying to process.

“I thought I was too emotional to handle finances,” I said quietly.

He had the grace to look uncomfortable. “This is different. This is a crisis. I need—we need someone who actually knows this stuff. You’re a CPA, you know how to—”

“I’m a CPA who isn’t allowed to see her own bank accounts, Marcus.”

Silence.

“Can you just—can you look at this? Please? It’s my mom.” His voice cracked. He looked genuinely scared.

And despite everything, despite four years of being shut out and talked down to, I felt for him. This was his mom. And I do actually love her.

“Okay,” I said. “Let me see what you’re working with. Pull up our accounts.”

That’s when things got really interesting.

Marcus pulled out his laptop and logged into our joint account—the one I haven’t seen in four years. And then our savings account. And then… three credit card accounts I didn’t know existed.

“Walk me through everything,” I said, slipping into work mode. “Income, fixed expenses, debt, savings, all of it.”

For the next two hours, I went through our entire financial picture. And with every screen Marcus pulled up, I felt my blood pressure rising.

Our savings account—the one that had $40K when he took over—had $4,200 in it.

Four. Thousand. Two. Hundred. Dollars.

“Where did the savings go?” I asked, keeping my voice level.

“Well, you know, the truck, and we had some house repairs, and—”

“The truck was $52,000, Marcus. Where’s the rest?”

He got defensive. “It’s not like we’ve just been blowing money! Life is expensive!”

I moved on to the credit cards. Three of them. Balances: $8,400, $6,200, and $11,800.

Over $26,000 in credit card debt.

“What is this from?” I asked.

“Just… stuff. Regular expenses. It builds up.”

I started going through the statements. Here’s what “regular expenses” looked like:

- $3,200 at Best Buy over six months (new TV, sound system, gaming setup)

- $4,800 to his golf club (membership fees, equipment, tournament entries)

- $2,100 in Vegas over two guys’ trips

- $1,850 at various sports bars and restaurants

- $960 in subscriptions (streaming services, gaming, apps—most of which I didn’t know we had)

- $2,400 for car modifications and detailing for his truck

And that was just the stuff I could easily identify in a quick scroll.

Meanwhile, I saw my $450/month “allowance” hitting my account like clockwork. Money I was using for groceries, household items, gas, and occasionally treating myself to a $12 Target candle that I felt guilty about buying.

I closed the laptop.

“So let me get this straight,” I said. “Over the past four years, you’ve drained our savings, racked up $26K in credit card debt, and spent money on toys and trips. And during that entire time, you told me I was too emotional and unstable to be trusted with our finances.”

“It’s not that simple—”

“And now your mother needs $30,000, and suddenly I’m the one you need? Because you’ve mismanaged our money so badly that you don’t know how to fix it?”

He didn’t answer.

“Marcus, we should have over $100,000 in savings right now. Do you understand that? Based on our income and reasonable expenses, we should have built up significant savings over four years. Instead, we have $4K and $26K in debt. We’re $120,000 away from where we should be.”

“I didn’t—I wasn’t trying to—” He looked lost.

I opened my personal laptop. Pulled up my spreadsheet. The one I’d been keeping for two years.

“I’ve been tracking what I could see,” I said, turning the screen toward him. “Every purchase you mentioned. Every expense I knew about. Every time you said I was too unstable to handle money, I was quietly watching you prove that you couldn’t handle it either.”

His face went white as he looked at my spreadsheet. Rows and rows of data. Dates. Purchases. Estimates. Patterns.

“You’ve been… tracking me?”

“I’ve been tracking what should have been OUR money, Marcus. Money I earned just as much as you did. Money I was shut out from because I had the audacity to grieve a miscarriage.”

We didn’t speak for the rest of the night.

Yesterday morning, Patricia called in tears. The timeshare company had sent another threatening letter. She was panicking.

I answered the phone.

“Patricia, it’s going to be okay,” I said. “I’m going to help you. Send me all your paperwork—the timeshare contract, the line of credit documents, everything. I’m going to look at it today.”

“Oh honey, thank you. Thank you so much. Marcus said you’d know what to do.”

After we hung up, Marcus looked at me from the kitchen doorway.

“Thank you,” he said quietly. “For helping her.”

“I’m not doing this for you,” I said. “I’m doing it for her. She’s a victim of a predatory scam, and I’m not going to let her lose her house.”

I spent yesterday working on Patricia’s situation. Called the timeshare company, documented everything, researched her state’s consumer protection laws. Found out the “financial advisor” who sold her this wasn’t even licensed. Found out the timeshare company has a class-action lawsuit pending against them for fraudulent practices.

Called a lawyer friend who specializes in consumer protection. Sent him everything. He thinks Patricia has a strong case to get out of the contract entirely and possibly recover the money she’s already paid.

“She probably won’t need to pay the $30K at all,” I told Marcus last night. “If we fight this correctly. But it’s going to take time and she needs a real attorney, which will cost maybe $5K upfront.”

“Where are we going to get $5K?” he asked, sounding defeated.

I looked at him. “You’re going to sell your truck.”

“What?”

“Your truck is worth about $45K right now. You owe $31K on it. That’s $14K in equity. You’re going to sell it, pay off the loan, and use the remaining cash to pay your mom’s attorney and start paying down our credit card debt.”

“I need that truck for—”

“You need it for what, Marcus? Your ego? You’re going to drive the 2012 Honda Civic we already own and paid off years ago. The one that’s been sitting in the garage because you wanted something flashier.”

He started to argue, then stopped. He knows I’m right.

This morning, Patricia called me again. I explained everything I’d found, the lawyer I’d connected her with, the plan going forward.

She cried with relief. “You saved me. I was so scared. Thank you. Thank you.”

After we hung up, she called Marcus. I could hear her through the phone from across the room.

“Your wife is brilliant. She’s absolutely brilliant. I don’t know what I would have done without her. You’re so lucky to have someone that smart and capable.”

Marcus looked at me. Really looked at me.

“I’m sorry,” he said after he hung up.

“For what specifically?” I asked.

“For… for all of it. For shutting you out. For spending our money without thinking about our future. For telling you that you were too emotional when really I just… I wanted control. I wanted to feel like the provider, like I was handling everything, and I fucked it all up.”

I sat down. “Marcus, I had two miscarriages. I was grieving. I needed support, not to be treated like I was incompetent. You used the worst moments of my life as an excuse to take away my autonomy.”

“I know.” His voice was shaky. “I know, and I’m so sorry. I convinced myself I was protecting you, but really I was just… I don’t know. My dad always handled the money in my family. I thought that’s what I was supposed to do.”

“Your dad also didn’t shut your mom out completely. And your dad didn’t rack up credit card debt on toys.”

He nodded, looking miserable.

So now I’m sitting here, and I don’t know what to do.

Part of me wants to take the spreadsheet I’ve been keeping, take screenshots of all our accounts, and walk straight to a divorce attorney. Four years of financial abuse and gaslighting is four years too many.

But another part of me sees that he genuinely seems to understand what he did wrong. He’s already listed his truck for sale. He’s agreed to couples counseling. He’s agreed to add me back to all accounts immediately and never, EVER make a financial decision without me again.

He’s also agreed that I’m taking over the finances. All of them. He gets an allowance now—the same $450/month I’ve been living on. “So you can see what it feels like,” I told him.

My friends are split. Half say I should leave him—that financial abuse is abuse, period, and that four years of being treated like I’m incompetent is unforgivable. The other half say that if he’s genuinely willing to change, and if we address this in therapy, maybe the marriage can be saved.

His mom called me twice more today to thank me. She has no idea what’s been going on in our marriage. She just knows I saved her house.

And honestly? I’m proud of that. I’m proud that I kept my skills sharp, that I kept tracking and paying attention even when I was shut out, that I was able to step in and actually help when it mattered.

But I’m also exhausted. And angry. And I keep thinking about the last four years—every time I had to ask permission to buy something, every time he made me feel like I was crazy for wanting to see our accounts, every time he spent money on himself while I was clipping coupons.

So, I’m asking: AITA for being furious that it took a family crisis for my husband to realize I’m not “too emotional” to handle money? And more importantly: Is this something therapy can fix, or should I be talking to a lawyer instead?

EDIT because people keep asking: Yes, I’ve already changed all the passwords and added myself back to every account. I have full access now. I’ve also moved half of what’s in our accounts to a separate account in my name only, which legally I’m entitled to do. If he wants to divorce me over taking what’s mine, he’s welcome to try.

EDIT 2: His truck sold this morning. $44,500. After paying off his loan, we have $13,500. $5K is going to his mom’s attorney retainer. The rest is going to credit card debt. He cried when the buyer drove away. I feel… nothing about that.

EDIT 3: To everyone asking why I stayed for four years: That’s a fair question and I’m asking myself the same thing. I think I was so deep in grief after the miscarriages, and then so worn down by his constant messaging that I was “unstable,” that I started believing it. Therapy helped me individually, but I never told my therapist about the financial control because he framed it as temporary and protective. I’m realizing now how much I was gaslit.